Chinese companies are showing interest in buying up Volkswagen's factories in Germany, a strategic move that could potentially transform the automotive industry in Europe. The investments would strengthen China's presence in European vehicle production, but also raise concerns about the future of the industry and political reactions.

Volkswagen plans to close its factories in Dresden and Osnabrück by 2027 – as part of the company's fight to cut costs and face stiffening competition from Chinese electric car makers.

Volkswagen might consider selling the Osnabrück factory to a Chinese buyer, according to a person familiar with the company’s deliberations who spoke to Reuters.

However, a Volkswagen spokesperson emphasizes that "We are committed to finding a continued use for the site. The goal must be a viable solution that takes into account the interests of the company and employees".

Could bypass car tariffs

Chinese investment in Germany has in the past included sectors such as telecommunications and robotics, but establishment in traditional car manufacturing has so far failed to materialize.

The Chinese are interested in car manufacturing in Europe in general, potentially avoiding EU tariffs on imported electric cars and strengthening their market presence, as several manufacturers have already done. For example, BYD is building plants in Hungary and Turkey, while Chery plans to start manufacturing at a former Nissan plant in Spain. Leapmotor has also considered using a factory in Germany for its production.

Reuters also reports that a source close to the Chinese government said that Chinese companies are actively exploring opportunities to buy factories that Volkswagen plans to close.

A spokesman for China's Foreign Ministry urged Germany to welcome Chinese investment.

– China has introduced a series of opening-up measures to create new business opportunities for foreign companies … It is hoped that the German side will also uphold an open mind, (and) provide a fair, just and non-discriminatory business environment for Chinese firms to invest.

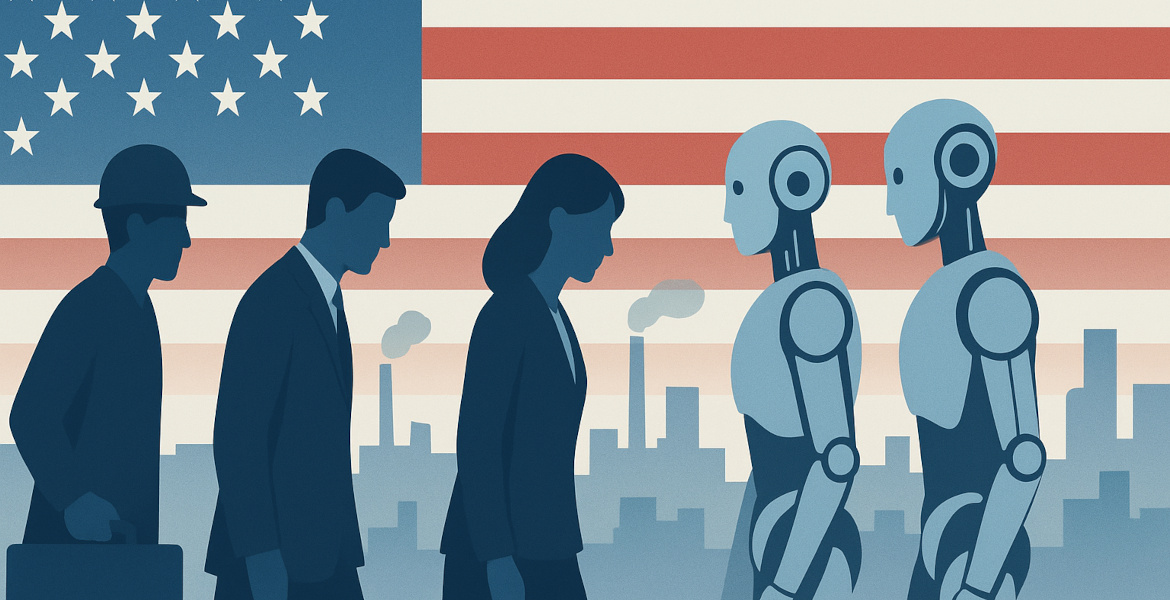

Opposition from German trade unions

However, a sale of Volkswagen's plants to Chinese operators could face opposition from German trade unions, which have significant influence and may demand guarantees on jobs and factory locations.

Moreover, relations between Germany and China have become increasingly strained in recent years and, in light of the upcoming German elections, the decision-making process on Chinese investment currently appears somewhat uncertain.

However, selling factories to Chinese companies could prove to be financially beneficial for Volkswagen. According to an anonymous source, a sale could generate revenues of between €100 million and €300 million per plant.

At the same time, it also carries the risk of German car brands losing their historical edge and competitiveness in Germany, which is the largest national car market in Europe.

Facts about Volkswagen:

Volkswagen was founded in 1937 in Germany on the initiative of then Chancellor Adolf Hitler, as part of a drive for a people's car for all. After World War II, the company recovered to become a global automotive player, known for iconic models such as the Volkswagen Type 1 (the "Beetle"). Today, Volkswagen is one of the world's largest car manufacturers, owning brands such as Audi, Porsche and Skoda.