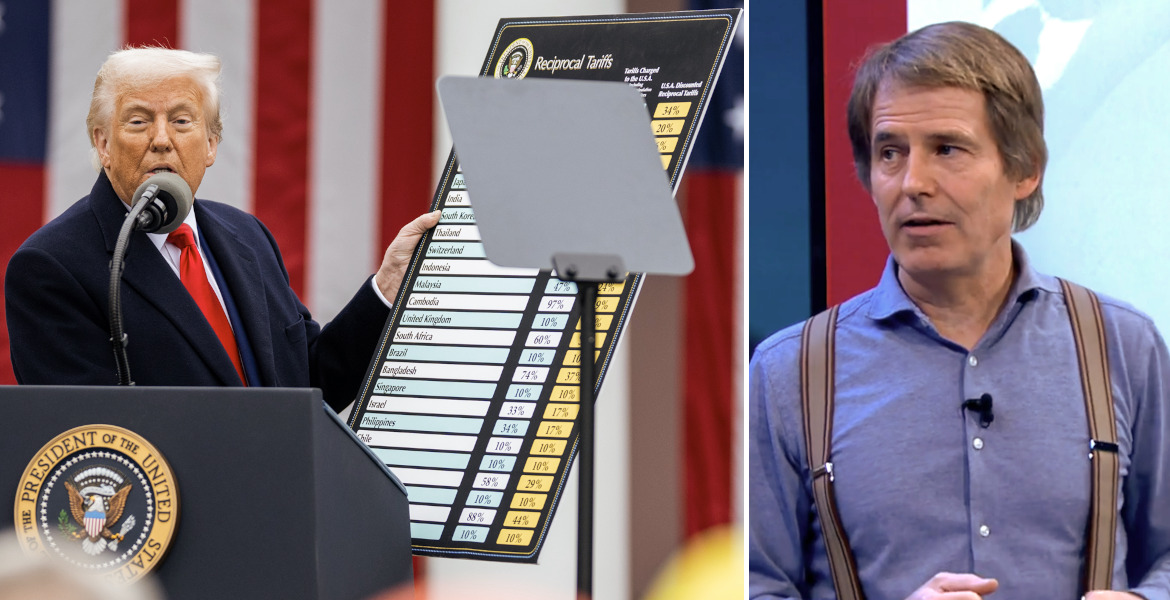

The announcement of Trump's trade tariffs and the world's response in the form of counter-tariffs have led to blood-red figures on the stock market and alarms that the world economy may be heading for a historic crash.

The fall continued on Monday, but independent economist Claes Hemberg believes that the panic is greatly exaggerated, that the crisis is temporary and that the Swedish economy as a whole is likely to do relatively well.

Hemberg compares the situation to covid and the lockdown policy five years ago and believes that we are now facing something similar – where it is now tariffs instead of lockdowns that create economic uncertainty.

The economist explains that the stock market's reaction is not due to the poor performance of individual companies, but to uncertainty about future economic developments, interest rates, household finances, international trade and politics.

– For the economy, there is probably no consequence at all, but the stock market is allowed to make a mess of things like this. It's not strange, it happens. However, economists, politicians and business leaders must agree on how we should work going forward.

– We cannot surprise each other with different punitive tariffs or taxes, but we have to find a way to work together so that we can build relationships for the long term, because that's how economics works. It is based on trust, not on surprises, shock therapies, false promises or false threats for that matter, he continued on state television SVT.

"A small delay"

As for the Swedish economy, Hemberg believes that the expected economic recovery is likely to be delayed due to the prevailing uncertainty, but that the effect is expected to be short-lived.

– We will probably only have a small delay. Households are waiting to start consuming, buying a new sofa or new clothes for that matter. There have been higher wages just last week, and we see that interest rates will be low going forward here.

– The tariffs are here and causing some disruption, but it's probably a temporary issue that we’re discussing and will sort out in the near future. It shouldn't truly affect our economy - just delay the recovery by a few weeks or maybe a month, he speculates.

"Trump is talking nonsense"

He emphasizes that the market unrest should be seen more as a reaction to the surprise element of the tariffs rather than genuine concern over the economy itself. Hemberg also believes that anyone with a 10- or 20-year investment horizon should sit tight and not panic-sell their funds or stocks, despite the steep downturn. This is because today’s developments won’t affect long-term goals.

– Sometimes there’s thunder and storms in our economy, and today is one of those days. That’s when you stay indoors, watch a movie, or maybe bake some cinnamon buns. Don’t go out now, stay home, I’d say.

Trump has also called on the US Federal Reserve to lower interest rates, something that Hemberg is very critical of.

– He’s quite consistent in claiming and pointing out things that are not a president’s business. The US has an independent central bank, just like Sweden. It’s a public authority responsible for monitoring inflation and the labor market to maintain a rate that supports society, not one influenced by White House politics

"Can't act like this"

China has responded to Trump's announcement by imposing its own counter-tariffs, and Hemberg believes that many are inspired by the Chinese and that the EU or Japan may make similar decisions.

– Maybe China is signaling here that they don’t support the kind of politics Trump is promoting and are responding in kind.

– That might have come as a bit of a surprise. But at some point, we also need clear signals back to the White House that you can’t act like this. If we want a society that encourages discussion, mutual trust, and the kind of global trade we so badly need, this won’t do.

"The stock market is a weather vane"

The economist believes that the stock market turmoil will continue for a couple more weeks at most – and that the reason is that we simply have not been in this situation before.

– It’s not a big deal if the market jumps around a bit. It does that sometimes, and we just have to accept it. These uncertain days are often very short, intense, and uncomfortable, and they might make our stomachs churn a little.

Hemberg argues that the Swedish krona is unusually strong today and that Swedes will be able to travel more than before, that energy prices are coming down and that there are several other good economic signs.

– Just because there is a person in the White House in the United States who does not understand economics, I do not think we should be worried - even if the stock market is currently turbulent.

– Economics is something that spans over time - many generations, frankly. It’s not something we solve today or this afternoon. The stock market is just a kind of weather vane showing us where things are heading right now - and that fluctuates, and should fluctuate.

"More medicine and bandages needed"

He speculates that Trump may propose new negotiations in response to the counter-tariffs, and that there are likely to be new talks and discussions where all parties agree to back down.

– Just look at what happened five years ago when he was president. It was the same kind of tariff talk then.

– Now the tariffs are broader, tougher, and more intense, so we need more medicine, more bandages, and more talks. It'll likely take a week or so to sort this out, but we can’t have a policy that’s so surprising or marked by such poor cooperation.

"No big surprises"

With regard to the development of inflation, Claes Hemberg believes that it simply moves in cycles – and that it tends to rise at the beginning of the year, but then falls slightly in the spring.

– There are no big surprises. Energy prices are falling, gasoline prices are falling, and yes, things are looking good for our economy. The economy is hopefully gaining momentum here.

– Swedish households are quite cautious after these years of high inflation, and I understand that - that it takes time to win back their confidence again, and the Riksbank is struggling with this. That's their main goal - to get households to come back to the shops and consume and live a normal life again, he concludes.