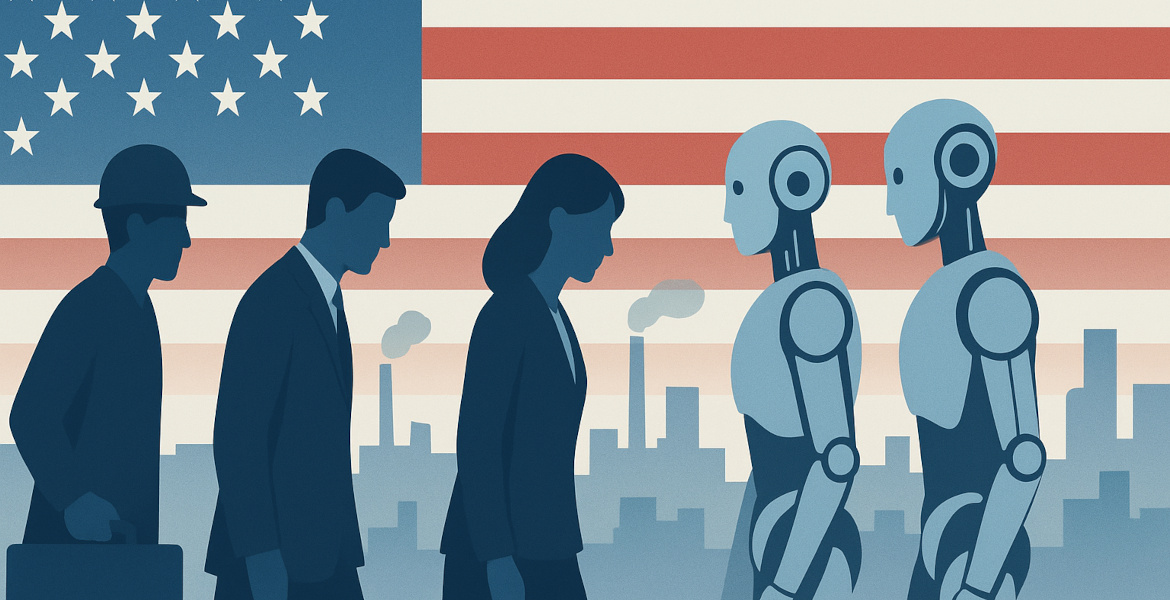

In October, American companies announced over 153,000 layoffs, the highest figure for the month in over 20 years. The increased use of AI technology is identified as a key factor behind the extensive workforce reductions.

The American outplacement firm Challenger, Gray & Christmas reports that October 2025 became a record month for layoffs with over 153,000 jobs eliminated, nearly three times more than the same month the previous year.

The technology and warehouse sectors are hit hardest, where AI combined with weaker demand and increased costs contributes to the cutbacks.

– Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes, says Andy Challenger, chief revenue officer at Challenger, Gray & Christmas.

He also warns that those now losing their jobs will find it harder to quickly secure new employment, which could further weaken the labor market.

Extensive cutbacks at major companies

Companies such as Target, Amazon, Paramount Skydance, Starbucks, Delta Air Lines, CarMax, Rivian, and Molson Coors have collectively eliminated tens of thousands of positions.

For example, Amazon recently laid off 14,000 employees and Target approximately 1,800. Several companies cite automation as a factor, as well as the need to reduce middle management positions.

UPS has also increased its planned workforce reductions by 70 percent to 34,000 people, stating that higher productivity thanks to automation makes this possible.

In total, over one million jobs have been eliminated in the US so far this year. Plans for new hires are at their lowest since 2011, and many analysts expect a weaker labor market during 2025.

–It’s possible with rate cuts and a strong showing in November, companies may make a late season push for employees, but at this point, we do not expect a strong seasonal hiring environment in 2025, says Challenger in his report.

Government shutdown complicates matters

Additionally, it has been difficult to assess the US labor market's development due to the federal government shutdown in the country – which has now become the longest ever.

Official economic statistics have not been released since early October, including the Department of Labor's closely watched employment report, which includes unemployment figures and monthly wage development data.

Federal Reserve Chair Jerome Powell noted during a press conference in October that private data cannot replace government figures, which are widely regarded as the gold standard for measuring the world's largest economy.

The continued absence of government figures may also negatively impact monetary policy and jeopardize future interest rate cuts in the US.